1. Market Landscape: Europe & US Dominate High-End, China Accelerates Catch-Up

2. Core Operating Data of Global Giants

1. Lattice

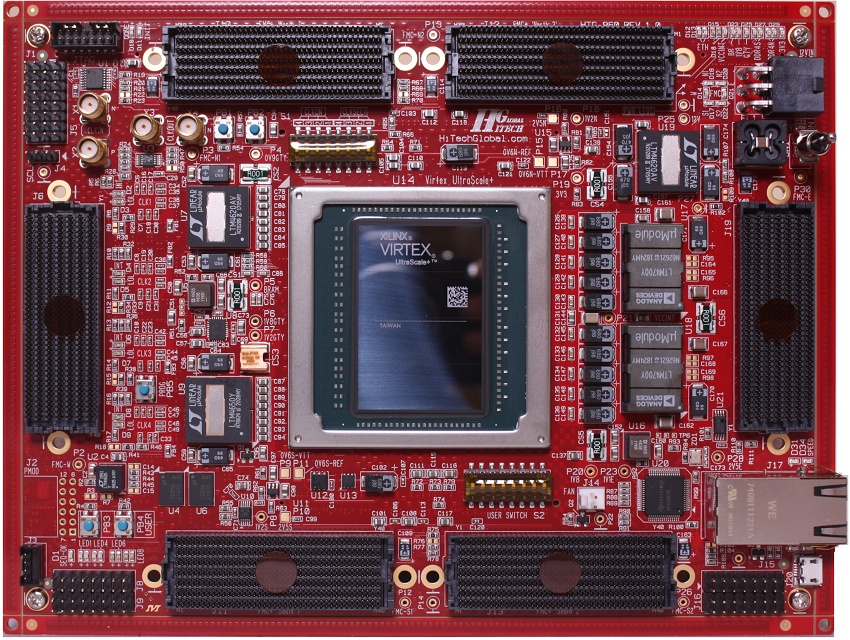

2. Xilinx (under AMD)

3. Altera

3. Performance of A-Share FPGA Enterprises

1. Fudan Microelectronics

2. Ziguang Guowei

3. Anlu Technology

4. Conclusion

Currently, the market presents a pattern where "Europe & US control the high-end, while China catches up in the mid-to-low-end". Although domestic enterprises face challenges such as revenue fluctuations and profit pressure, their high R&D input (e.g., Anlu Technology) and in-depth scenario cultivation (e.g., Ziguang Guowei) demonstrate the potential of domestic substitution. In the future, with the continuous release of demand for FPGAs in emerging scenarios like AI, edge computing, and automotive electronics, the industry will expand. Domestic enterprises are expected to gain a more important position in the global pattern after addressing their shortcomings.

ICGOODFIND Summary

As an electronic component supply chain platform, ICGOODFIND connects global FPGA giants (Xilinx, Lattice) and domestic enterprises (Anlu Technology, Fudan Microelectronics), providing spot supply and technical support to facilitate the implementation of high-end demand and the process of domestic substitution.